Smart Contracts in Real Estate: Revolutionizing Property Transactions

The real estate industry, traditionally characterized by complex and time-consuming transactions, is undergoing a digital transformation. One of the most groundbreaking advancements is the integration of smart contracts in real estate transactions. These self-executing contracts, embedded with the terms and conditions of an agreement, are stored and executed on blockchain networks. Smart contracts promise to streamline processes, reduce costs, and enhance transparency, making real estate transactions more efficient and secure.

What are Smart Contracts?

Smart contracts are digital protocols that facilitate, verify, and enforce the negotiation or performance of a contract. Unlike traditional contracts, which rely on intermediaries such as lawyers and brokers, smart contracts are automated and self-executing. They operate on blockchain technology, a decentralized and distributed digital ledger that records transactions across multiple computers. Once the conditions of a smart contract are met, the contract executes itself, ensuring that all parties fulfill their obligations.

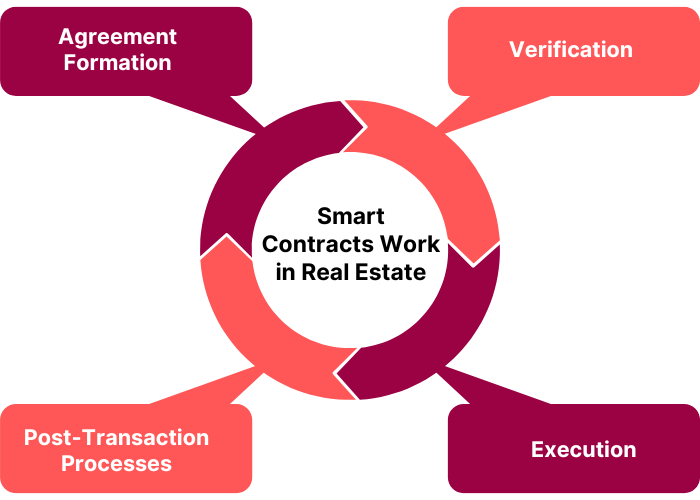

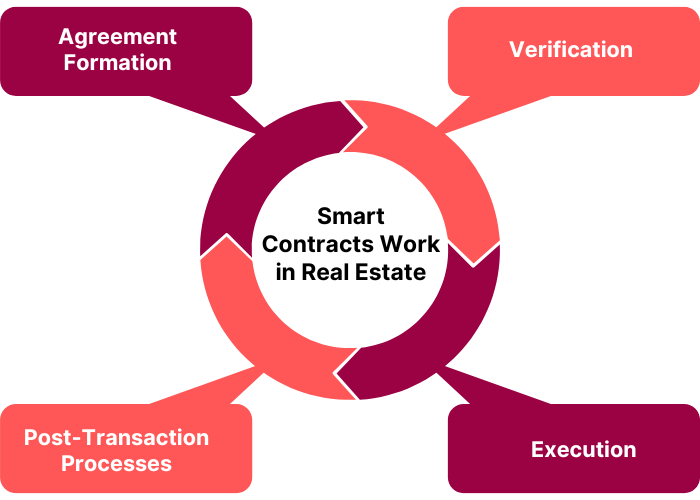

How Smart Contracts Work in Real Estate

In real estate, smart contracts can automate various aspects of property transactions. Here’s how they work:

- Agreement Formation: The buyer and seller agree on the terms of the transaction, which are then encoded into a smart contract. These terms might include the sale price, property details, and deadlines for completing various stages of the transaction.

- Verification: The smart contract verifies that the buyer has the necessary funds and that the property title is clear of liens or encumbrances. This verification is done through integrations with financial institutions and public property records.

- Execution: Upon successful verification, the smart contract executes the transaction. The buyer’s funds are transferred to the seller, and the property title is transferred to the buyer. The blockchain records the transaction, providing a transparent and tamper-proof record.

- Post-Transaction Processes: After the sale, the smart contract can handle post-transaction processes such as recording the sale with local government agencies and updating property records.

Benefits of Smart Contracts in Real Estate

- Efficiency: Smart contracts eliminate the need for intermediaries, reducing the time and effort required to complete a transaction. Automation speeds up processes such as verification, payment, and title transfer.

- Cost Reduction: By cutting out intermediaries and reducing administrative overhead, smart contracts lower transaction costs. Buyers and sellers can save on fees typically paid to lawyers, brokers, and escrow services.

- Transparency: Blockchain technology ensures that all transactions are recorded in a transparent and immutable ledger. This transparency builds trust among parties and reduces the risk of fraud.

- Security: Smart contracts are secure by design. They use cryptographic techniques to ensure that once a contract is executed, it cannot be altered. This security minimizes the risk of disputes and enhances the integrity of the transaction.

- Accessibility: Smart contracts can facilitate transactions across borders, making it easier for international buyers and sellers to engage in real estate transactions. This global accessibility can expand market opportunities.

Challenges and Considerations

While smart contracts offer significant advantages, there are challenges to consider:

- Legal Recognition: The legal framework for smart contracts is still evolving. Different jurisdictions have varying levels of acceptance and regulation regarding smart contracts. Ensuring that smart contracts are legally binding and enforceable is crucial.

- Technical Complexity: Developing and implementing smart contracts requires technical expertise. Real estate professionals may need to collaborate with blockchain developers to create and manage smart contracts effectively.

- Data Privacy: Ensuring the privacy of sensitive information, such as financial details and personal identification, is a concern. Blockchain technology must comply with data protection regulations to safeguard users’ privacy.

- Standardization: The lack of standardized protocols for smart contracts can lead to compatibility issues. Establishing industry standards can promote interoperability and streamline adoption.

Case Studies and Real-World Applications

Several real estate markets are already leveraging smart contracts to revolutionize property transactions:

- Propy: Propy, a global real estate platform, uses blockchain technology and smart contracts to facilitate cross-border property transactions. By automating processes such as title registration and payment, Propy reduces transaction time and costs.

- Atlant: Atlant is a blockchain platform that enables tokenized ownership of real estate. Through smart contracts, Atlant allows fractional ownership, making it easier for investors to buy and sell property shares.

- ShelterZoom: ShelterZoom offers a smart contract-based platform for real estate and rental transactions. Their technology streamlines offer and acceptance processes, making transactions faster and more transparent.

Future Trends

The future of smart contracts in real estate looks promising. Here are some trends to watch:

- Integration with IoT: The integration of smart contracts with the Internet of Things (IoT) can further automate property management. For instance, smart contracts can be used to automatically adjust rent payments based on occupancy rates or maintenance needs.

- Enhanced Security Features: As blockchain technology evolves, smart contracts will incorporate advanced security features such as multi-signature authentication and zero-knowledge proofs to enhance transaction security.

- Government Adoption: Governments are exploring the use of blockchain for land registries and property records. This adoption can streamline property registration processes and reduce fraud.

- AI and Machine Learning: Artificial intelligence (AI) and machine learning can enhance the functionality of smart contracts. AI can analyze large datasets to assess property values and predict market trends, while machine learning algorithms can optimize contract terms based on historical data.

Conclusion

Smart contracts are set to revolutionize real estate transactions by making them more efficient, cost-effective, transparent, and secure. As the technology matures and legal frameworks adapt, the adoption of smart contracts in real estate will likely accelerate. Real estate professionals, buyers, and sellers stand to benefit from this digital transformation, paving the way for a more streamlined and accessible property market.

Did you find this Legitt article worthwhile? More engaging blogs about smart contracts on the blockchain, contract management software and electronic signatures can be found in the Legitt Blogs section. You may also contact Legitt to hire the best contract lifecycle management services and solutions.

FAQs on Smart Contracts in Real Estate

What are smart contracts in real estate?

Smart contracts in real estate are self-executing digital contracts with terms directly written into code. They automate and verify property transactions on blockchain networks, ensuring that all parties fulfill their obligations without the need for intermediaries.

How do smart contracts work in real estate transactions?

Smart contracts automate various aspects of property transactions. They verify funds and property titles, execute the transfer of funds and property, and record the transaction on a blockchain, ensuring transparency and security throughout the process.

What are the benefits of using smart contracts in real estate?

Benefits include increased efficiency, cost reduction, enhanced transparency, improved security, and greater accessibility. Smart contracts streamline processes, reduce the need for intermediaries, and provide a secure and transparent transaction record.

Are smart contracts legally recognized?

The legal recognition of smart contracts varies by jurisdiction. While some regions have begun to recognize and regulate smart contracts, others are still developing the necessary legal frameworks to ensure their enforceability.

What challenges do smart contracts face in real estate?

Challenges include legal recognition, technical complexity, data privacy concerns, and the need for standardization. Addressing these challenges is crucial for the widespread adoption of smart contracts in real estate.

Can smart contracts be used for international real estate transactions?

Yes, smart contracts facilitate cross-border transactions by automating processes and providing a transparent record. They make it easier for international buyers and sellers to engage in real estate transactions.

How do smart contracts ensure the security of real estate transactions?

Smart contracts use cryptographic techniques to secure transactions. Once executed, the contract terms cannot be altered, reducing the risk of disputes and enhancing the integrity of the transaction.

What is Propy and how does it use smart contracts?

Propy is a global real estate platform that uses blockchain technology and smart contracts to facilitate cross-border property transactions. It automates title registration and payment processes, reducing transaction time and costs.

How does tokenized ownership work in real estate?

Tokenized ownership allows fractional ownership of real estate through blockchain platforms. Smart contracts facilitate the buying and selling of property shares, making it easier for investors to participate in the real estate market.

What role do IoT and smart contracts play in property management?

IoT devices can integrate with smart contracts to automate property management tasks. For example, smart contracts can automatically adjust rent payments based on occupancy rates or trigger maintenance requests when certain conditions are met.

What future trends are expected for smart contracts in real estate?

Future trends include integration with IoT, enhanced security features, government adoption of blockchain for land registries, and the use of AI and machine learning to optimize contract terms and assess property values.

How can real estate professionals adapt to smart contract technology?

Real estate professionals can adapt by gaining knowledge about blockchain and smart contracts, collaborating with blockchain developers, and staying informed about legal and regulatory developments in their jurisdictions.

What is ShelterZoom and its contribution to real estate transactions?

ShelterZoom is a platform that uses smart contracts to streamline real estate and rental transactions. It enhances the offer and acceptance process, making transactions faster and more transparent.

How do smart contracts reduce transaction costs in real estate?

Smart contracts eliminate the need for intermediaries such as lawyers and brokers, reducing administrative overhead and associated fees. This cost reduction benefits both buyers and sellers.

What are the privacy concerns associated with smart contracts in real estate?

Ensuring the privacy of sensitive information, such as financial details and personal identification, is a concern. Blockchain technology must comply with data protection regulations to safeguard users' privacy and secure sensitive data.

Categories Contract Management Software

Assisted Contract Lifecycle Management with the power of AI and Blockchain. Manage Contracts Smarter, Faster and Easier with intelligence embedded in each step.

- About Us

- Privacy Policy

- Terms & Conditions

- Jobs & Careers

- Invest With Us