- If the credit union does not offer or purchase the types of credit that would be consumer credit within the meaning of the MLA, the regulation does not apply and no further review is necessary;

- If the credit union offers or purchases any of the types of credit that would be consumer credit within the meaning of the MLA, use the following procedures to determine whether the credit union complies with the MLA.

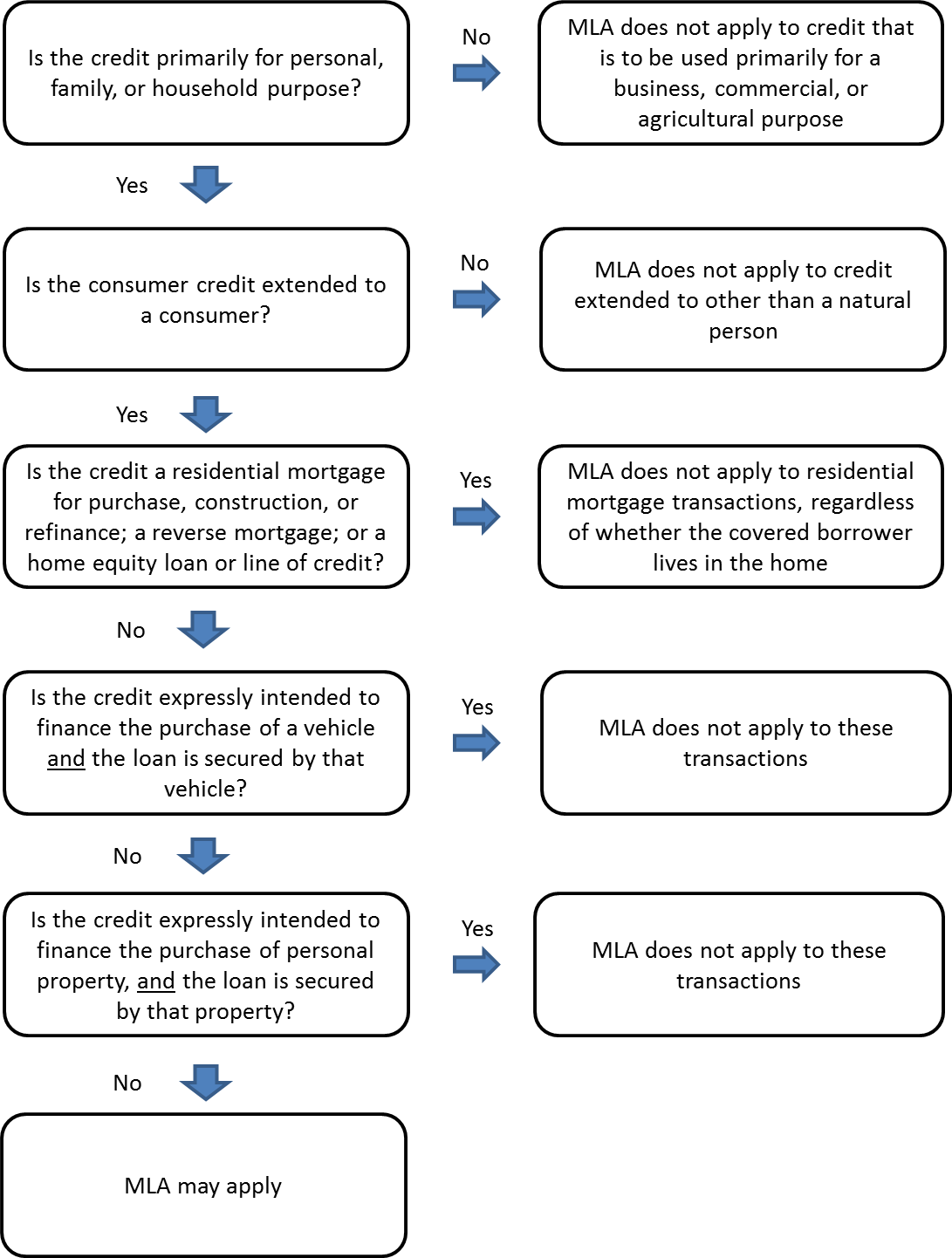

The following flowchart may be helpful in determining MLA applicability to a particular extension of credit to a covered borrower:

Flowchart Alternative Text

Is the Credit primarily for personal, family, or household purpose? If no, the MLA does not apply to the credit that is to be used primarily for a business, commercial, or agricultural purpose.

If yes, then, is the consumer credit extended to a consumer? If no, the MLA does not apply to credit extended to the other than a natural person.

If yes, is the credit a residential mortgage for purchase, construction, or refinance; a reverse mortgage; or a home equity loan or line of credit? If yes, the MLA does not apply to residential mortgage transactions regardless of whether the covered borrower lives in the home.

If no, is the credit expressly intended to finance the purchase of a vehicle and the loan is secured by that vehicle? If yes, the MLA does not apply to these transactions.

If no, is the credit expressly intended to finance the purchase of personal property, and the loan is secured by that property? If yes, the MLA does not apply to these transactions.

If no, the MLA may apply.

Evaluate Compliance Management System

- Determine the extent and adequacy of the credit union’s policies, procedures, and practices for ensuring and monitoring compliance with the MLA.

- Determine the extent and adequacy of the training received by individuals whose responsibilities relate to compliance with the MLA. Review any training materials pertaining to the MLA and determine whether the training is comprehensive and covers the various aspects of the provisions that apply to the credit union’s offerings and operations.

- Determine if the credit union has policies or procedures in place to:

- Provide account disclosure information to covered borrowers in accordance with § 232.6;

- Correctly determine which fees it charges are required to be included in the calculation of the MAPR;

- Correctly calculate and limit the MAPR (including waiving amounts necessary in order to comply with the limit at the outset of a transaction and at the end of a billing cycle on open-end credit, as applicable) as defined in § 232.3(p) and in accordance with § 232.4(c); and

- Properly create and maintain records of covered borrower checks.

- The scope of any audits address all provisions of the regulation, as applicable;

- Transaction testing includes samples covering all relevant product types and decision centers;

- The work performed is accurate;

- Significant deficiencies and their causes are included in reports to management or to the board of directors;

- Management has taken corrective actions to follow up on previously identified deficiencies; and

- The frequency of review/audit is appropriate (including review/audit of implemented corrective action related to previously identified deficiencies).

- Organization charts;

- Process flowcharts;

- Policies and procedures;

- Account documentation;

- Checklists; and

- Computer program documentation, including any computer program testing and validation.

Identification of Covered Borrowers

- Determine whether the credit union’s policies, procedures, and training materials accurately reflect the scope of the “covered borrower” definition.

Note: § 232.5 contains no specific timing and recordkeeping requirements if the credit union uses an alternative to one of the safe harbors to verify covered borrower status. However, any alternative method selected by the credit union should be evaluated to determine whether it is reasonable and verifiable, and whether it addresses the risk of extending consumer credit that does not comply with the MLA to a covered borrower.

- Regarding an action by a credit union relating to a covered borrower with an existing account, if a credit union has elected to use one of the two optional safe harbor methods, determine whether the credit union also uses one of the safe harbor methods when extending a new consumer credit product or newly establishing an account for consumer credit, including a new line of consumer credit that might be associated with a pre-existing transactional account held by the borrower.

Calculation of MAPR

- Determine whether the credit union includes the following charges in the calculation of the MAPR for both closed- and open-end credit, as applicable:

- Any credit insurance premium or fee, any charge for single premium credit insurance, any fee for a debt cancellation contract, or any fee for a debt suspension agreement;

- Any fee for a credit-related ancillary product sold in connection with the credit transaction for closed-end credit or an account for open-end credit; and

- Except for a bona fide fee (other than a periodic rate) charged to a credit card account, which may be excluded if the bona fide fee is reasonable for that type of fee:

- Finance charges associated with the consumer credit;

- Any application fee charged to a covered borrower who applies for consumer credit, other than an application fee charged by a federal credit union when making a short-term, small amount loan provided that the application fee is charged to the covered borrower not more than once in any rolling 12-month period; and

- Any fee imposed for participation in any plan or arrangement for consumer credit other than as permitted under §232.4(c)(2)(ii)(B).

Mandatory Loan Disclosures

- Determine whether the credit union properly provides the covered borrower with required information before or at the time the borrower becomes obligated on the transaction or establishes an account for the consumer credit, including:

- A statement of the MAPR applicable to the extension of consumer credit;

- Any disclosure required by Regulation Z, which shall be provided only in accordance with the requirements of Regulation Z that apply to that disclosure; and

- A clear description of the payment obligation of the covered borrower, as applicable. Note that a payment schedule (in the case of closed-end credit) or account-opening disclosure (in the case of open-end credit) provided pursuant to Regulation Z satisfies this requirement. Also note that for oral disclosures, a generic, clear description of the payment obligation is permissible.

- A form the credit union directs the consumer to use to apply for the transaction or account involving consumer credit; or

- The written disclosure the credit union provides to the covered borrower.

Other Limitations

- Determine whether the creditor abides by the prohibition on rolling over, renewing, repaying, refinancing, or consolidating consumer credit. Note that this prohibition does not apply to a creditor that is chartered or licensed under Federal or State law as a bank, savings association, or credit union, or when the credit is being extended by the same creditor to refinance or renew an extension of credit that was not covered because the consumer was not a covered borrower at the time of the original transaction.

- Determine whether the credit union abides by the prohibitions against requiring covered borrowers to:

- Waive their rights to legal recourse under any otherwise applicable law;

- Submit to arbitration or other onerous legal notice provisions in the case of a dispute; or

- Provide unreasonable notice as a condition for legal action.

- Require that a covered borrower repay the obligation by military allotment (note that for purposes of this provision of the regulation, the term “creditor” does not include “military welfare societies” or “service relief societies”);

- Prohibit a covered borrower from prepaying the consumer credit; or

- Charge a covered borrower a penalty fee for prepaying all or part of the consumer credit [10] .

- Obtaining payment through a remotely created check or remotely created payment order; or

- Obtaining a post-dated check provided at or around the time credit is extended.

MILITARY LENDING ACT (MLA)

CHECKLISTApplicability of the Regulation

Applicability of the Regulation

Item Description Yes No N/A 1 Does the credit union offer, extend, or purchase credit primarily for personal, family, or household purposes?

If the answer is Yes, proceed. If the answer is No or N/A, conclude the review.Evaluate Compliance Management System

Evaluate Compliance Management System

Item Description Yes No N/A 2 Does the credit union have adequate policies, procedures, and practices for ensuring and monitoring compliance with the MLA? 3 Does the credit union provide adequate training for individuals whose responsibilities relate to compliance with the MLA? 4 Does the credit union have policies or procedures in place to: N/A N/A N/A 4(a) Provide account disclosure information to covered borrowers in accordance with § 232.6; 4(b) Correctly determine which fees that the credit union charges are required to be included in the calculation of the MAPR; 4(c) Correctly calculate and limit the MAPR (including waiving amounts necessary in order to comply with the limit at the outset of a transaction and at the end of a billing cycle on open-end credit, as applicable) as defined in § 232.3(p) and in accordance with § 232.4(c); and 4(d) Properly create and maintain records of covered borrower checks? 5 Based on a review of the credit union’s compliance reviews and/or audit materials, including workpapers and reports: N/A N/A N/A 5(a) Does the scope of any audits address all provisions of the regulation, as applicable? 5(b) Does transaction testing include samples covering all relevant product types and decision centers? 5(c) Is the work performed accurate? 5(d) Are significant deficiencies and their causes included in reports to management or to the board of directors? 5(e) Has management taken corrective actions to follow up on previously identified deficiencies? 5(f) Is the frequency of review/audit appropriate (including review/audit of implemented corrective action related to previously identified deficiencies)? 6 Are the credit union’s internal controls adequate to ensure compliance? Identification of Covered Borrowers

Identification of Covered Borrowers

Item Description Yes No N/A 7 Do the credit union’s policies, procedures, and training materials accurately reflect the scope of the “covered borrower” definition? 8 Has the credit union elected to use one of the optional safe harbor methods provided in § 232.5(b)? 9 If a credit union elects to use one of the two optional safe harbor methods to check a consumer’s status: N/A N/A N/A 9(a) Does the credit union timely create a record of the information obtained, in accordance with § 232.5(b)(3)? 9(b) Does the credit union thereafter maintain a record of the information obtained, in accordance with § 232.5(b)(3)? 9(c) Regarding an action by the credit union relating to a covered borrower with an existing account, does the credit union also use one of the safe harbor methods when extending a new consumer credit product or newly establishing an account for consumer credit, including a new line of consumer credit that might be associated with a pre-existing transactional account held by the borrower? 10 If a credit union elects to use a method other than one of the two optional safe harbor methods: N/A N/A N/A 10(a) Is the chosen method performed prior to a consumer becoming obligated on a credit transaction or establishing an account for credit? 10(b) Does the credit union maintain a record of the information obtained? Calculation of MAPR

Calculation of MAPR

Item Description Yes No N/A 11 Does the credit union include the following charges in the calculation of the MAPR for both closed- and open-end credit, as applicable: N/A N/A N/A 11(a) Any credit insurance premium or fee, any charge for single premium credit insurance, any fee for a debt cancellation contract, or any fee for a debt suspension agreement; 11(b) Any fee for a credit-related ancillary product sold in connection with the credit transaction for closed-end credit or an account for open-end credit; and 11(c) Except for a bona fide fee (other than a periodic rate) charged to a credit card account, which may be excluded if the bona fide fee is reasonable for that type of fee: N/A N/A N/A 11(c)(i) Finance charges associated with the consumer credit; 11(c)(ii) Any application fee charged to a covered borrower who applies for consumer credit, other than an application fee charged by a federal credit union when making a short-term, small amount loan provided that the application fee is charged to the covered borrower not more than once in any rolling 12-month period; and 11(c)(iii) In general, any fee imposed for participation in any plan or arrangement for consumer credit. 12 For closed-end credit, does the credit union appropriately calculate the MAPR following the rules for calculating and disclosing the “Annual Percentage Rate (APR)” for credit transactions under Regulation Z based on the MAPR charges? 13 For open-end credit, does the credit union appropriately calculate the MAPR following the rules for calculating the effective annual percentage rate for a billing cycle as set forth in 12 CFR § 1026.14(c) and (d) of Regulation Z (as if a credit union must comply with that section) based on the MAPR charges? Mandatory Loan Disclosures

- A form the credit union directs the consumer to use to apply for the transaction or account involving consumer credit; or

- The written disclosure the credit union provides to the covered borrower?

Other Limitations

Other Limitations

Item Description Yes No N/A 18 Does the credit union abide by the prohibitions against requiring covered borrowers to: N/A N/A N/A 18(a) Waive their rights to legal recourse under any otherwise applicable law; 18(b) Submit to arbitration or other onerous legal notice provisions in the case of a dispute; or 18(c) Provide unreasonable notice as a condition for legal action? 19 Does the creditor refrain from: N/A N/A N/A 19(a) Requiring that a covered borrower repay the obligation by military allotment (note that for purposes of this provision of the regulation, the term “creditor” does not include “military welfare societies” or “service relief societies”); 19(b) Prohibiting a covered borrower from prepaying the consumer credit; or 19(c) Charging a covered borrower a penalty fee for prepaying all or part of the consumer credit? 20 Does the credit union refrain from improperly requiring access to a deposit, savings, or other financial account maintained by the covered borrower for repayment by: N/A N/A N/A 20(a) Obtaining payment through a remotely created check or remotely created payment order; or 20(b) Obtaining a post-dated check provided at or around the time credit is extended? Footnotes

[1] The MAPR is calculated in accordance with 32 CFR §232.4(c).

[3] The MAPR largely parallels the APR, as calculated in accordance with Regulation Z, with some exceptions to ensure that creditors do not have incentives to evade the interest rate cap by shifting fees for the cost of the credit product away from those categories that would be included in the MAPR. Generally, a charge that is excluded as a “finance charge” under Regulation Z also would be excluded from the charges that must be included when calculating the MAPR. Late payment fees and required taxes—i.e., fees that are not directly related to the cost of credit—are examples of items excluded from both the APR and the MAPR. But certain other fees more directly related to the cost of credit are typically included in the MAPR, but not the APR. The most common examples of these fees—application fees and participation fees—have been specifically noted in the regulation as charges that generally must be included in the MAPR, but would not be included in the APR under Regulation Z.

[4] The Federal Credit Union Act prohibits federally chartered credit unions from charging a prepayment penalty on any loans (12 U.S.C. 1757(5)).

[5] National Defense Authorization Act for Fiscal Year 2013, Pub. L. 112-239, section 662(b), 126 Stat. 1786.

[7] An overdraft line of credit with a finance charge is a covered consumer credit product when: it is offered to a covered borrower; the credit extended by the creditor is primarily for personal, family, or household purposes; it is used to pay an item that overdraws an asset account and for which the covered borrower pays any fee or charge; and the extension of credit for the item and the imposition of a fee were previously agreed upon in writing.

[8] For purposes of the extended compliance date, the credit card accounts must be under an open-end (not home-secured) consumer credit plan. DoD may, by order, further extend the expiration of the limited exemption for credit card accounts to a date not later than October 3, 2018. For all other credit products, a creditor must comply with the applicable requirements of the July 2015 rule by October 3, 2016 for all consumer credit transactions or accounts for consumer credit consummated or established on or after October 3, 2016.

[9] These reflect FFIEC-approved procedures.

[10] A federal credit union cannot charge a prepayment penalty on any loans pursuant to the Federal Credit Union Act (12 U.S.C. 1757(5)).